Of food and fuel

Jyoti Rahman examines how agro-fuel demand is raising food prices worldwide

Politically, Bangladesh stands at a cross-road in 2008, with credible elections and sustained democracy being a realistically attainable choice. Yet, it is an economic issue that can overshadow all socio-political developments. Rising food price inflation — agflation — is arguably the greatest problem facing the country today. And while there are domestic factors at play, the global nature of agflation makes it difficult for the policymakers to stem its rise.

Politically, Bangladesh stands at a cross-road in 2008, with credible elections and sustained democracy being a realistically attainable choice. Yet, it is an economic issue that can overshadow all socio-political developments. Rising food price inflation — agflation — is arguably the greatest problem facing the country today. And while there are domestic factors at play, the global nature of agflation makes it difficult for the policymakers to stem its rise.

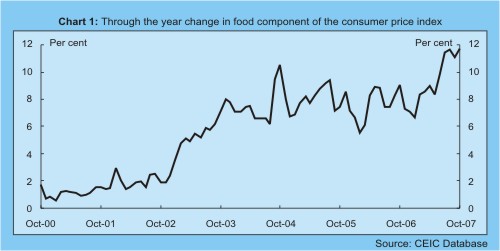

Although agflation started picking up in 2003, it has gathered pace in the past few months (Chart 1). Food prices rose by 11.7 per cent during the 12 months to October 2007, to be over 50 per cent higher than their 2002 levels.

There are many reasons for high and rising agflation. While the impact of Cyclone Sidr is not visible in the chart, it does show the impacts of the floods in the summer of 2007. As it was, prior to the flooding, there were already disruptions to the supply chain caused by various demolition drives and anti-corruption operations earlier in the year. The anti-corruption drive was, at least in part, a response to alleged market collusion that may have fuelled agflation before 2007. In addition to these shocks and microeconomic reasons, the depreciation of the taka against the Indian rupee also fuelled agflation in Bangladesh since late 2003.1

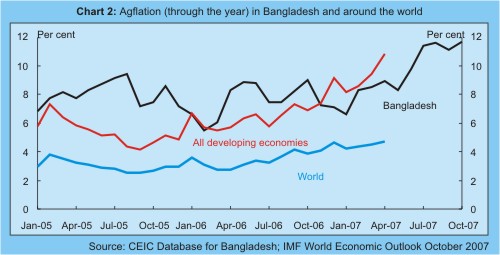

However, even if these domestic reasons were absent, it is likely that we would have to contend with high and rising agflation. This is because agflation is a global problem, as shown in Chart 2, which compares agflation in Bangladesh with international averages.

And the global agflation is set to continue into 2008, as a recent Financial Times article reports:

Global food prices will come under further pressure today as benchmark prices for cereals at much higher levels kick in, making it almost inevitable that a second wave of food price inflation will hit the world’s leading economies. In Chicago wheat and rice prices for delivery in March 2008 have jumped to an all-time record, soyabean prices are at a 34-year high and corn prices at an 11-year peak. Knock-on price rises are set to hit consumers in coming months, raising inflationary pressure and constraining the ability of central banks to mitigate the slowdown in their economies. A first wave of surging cereal prices hit the wholesale market during the summer and has fed through the supply chain and contributed to rising inflation.2

There are two major reasons behind this. The first — rising income in the emerging world — is a welcome development that the world will need to cope with. Rising income in the emerging world means that millions of people in these countries can now afford to have meat and dairy items on a regular basis. This has increased the price of farm and poultry produces. But animals are fed grain, so prices of cereal crops also rise.

The emergence of China, India and other such economies is not a sudden development. And it’s not only food prices that have increased recently as a result of increased demand from the emerging economies. Prices of oil and various metals have also been at historic highs in recent years.

That said, changes in diet and food consumptions that have come with rising prosperity have been gradual, whereas the rising global agflation is a much more sudden phenomenon. The more recent global agflation is a direct result of strong demand for subsidised corn-based ethanol as a fuel for cars.

With oil prices rising to around one hundred dollars a barrel, it is not surprising that consumers are looking for alternative fuels. The alternative liquid fuel that is the current favourite of American policymakers is ethanol, whose production is currently subsidised by legislation. In the United States, the grain of choice for ethanol production is corn, unlike the sugarcane used by Brazil for its ethanol. The US corn market, like for the rest of US agriculture, is already distorted by subsidies and interventions that are playing havoc in the world cereal markets. The artificial expansion of ethanol production has created an increase in the demand for its main input corn, driving up its price. American farmers have reacted by diverting productions away from other crop, raising their prices as well. According to the Economist:

This year the overall decline in stockpiles of all cereals will be about 53m tonnes — a very rough indication of by how much demand is outstripping supply. The increase in the amount of American maize going just to ethanol is about 30m tonnes. In other words, the demands of America’s ethanol programme alone account for over half the world’s unmet need for cereals. Without that programme, food prices would not be rising anything like as quickly as they have been.3

The Economist’s assessment is supported by the IMF. The director of its research department says:

In the IMF staff’s assessment, a significant part of the latest jump in food prices can be traced directly to biofuels policy.4

The US ethanol program has its origin in the idea of "energy security" — an end to American reliance on imported fossil fuel. But the way biofuel subsidies interact with other policies can actually produce more demand for fossil fuel. For example, production of "flexible-fuel vehicles" (that is, vehicles that can use both ethanol as well as fossil fuels) are subsidised. Because the fuel-economy credit is biggest for the least energy-efficient models, manufacturers concentrate on sport utility vehicles and light trucks. Yet almost all the drivers of these vehicles use ordinary petrol. The result is greater consumption of petrol, not less.5

Biofuels are subsidised in Europe as well. In both sides of Atlantic, climate change is another reason cited for the subsidies. But if that reason was genuine, then surely the most environmentally efficient sugar-based Brazilian ethanol wouldn’t have been prohibited from entering American and European markets through tariff.

Shafiq Alam/ driknews

Whatever the stated reason is, according to Global Subsidies Initiative, a Geneva-based think Initiative, a Geneva-based think tank, biofuel subsidies are really "farm programs masquerading as answers to energy insecurity and climate change."6

And what is the real price of this subsidy? Two statistics are widely quoted. According to studies by Gary Becker, a Nobel laureate from Chicago, a one-third rise in food prices reduces living standards in poor countries by a fifth. And according to the World Bank, the grain needed to fill up an SUV would feed a person for a year.

What would a more rational biofuels policy look like? The IMF recommends free trade in biofuels while levying a carbon tax on all fuels to reflect emissions costs, and promoting research and development of renewable energy. But the realistic chance

s of scrapping this farm subsidies program in favour of a more rational policy are perhaps not high during an election year.

Raj Aniket/ driknews

It is self-evident that our policymakers will have to manage the adverse impacts of food prices through macroeconomic and microeconomic policies in the short term. It is also clear that agricultural productivity needs to rise to increase food supply in the medium to long term. But agflation is going to continue to pose a problem for us, and the world, so long as American ethanol subsidies and similar interventions that distort the market place remain in effect.

So what should we do?

Our government needs to act through intergovernmental channels. But activists around the world need not wait for the governments. Global campaigns on issues ranging from Aids awareness to the third world debt have changed government policies. The time has now come for one against the ethanol subsidies. The grain needed to fill up an SUV would feed a person for a year — how can the world conscience not move?

Jyoti Rahman is an applied macroeconomist and a member of the Drishtipat Writers’ Collective.

1. Rahman J., On Agflation, Forum, November 2007.

2. Blas J., Giles C. and Weitzman H., Food price inflation poised for new surge, Financial Times, Dec 17, 2007.

3. Cheap no more, The Economist, December 6, 2007.

4. Johnson S., The (Food) price of success, Finance and Development, Dec 2007.

5. Wolf M., Biofuels: A tale of special interests and subsidies, Financial Times, Oct 30, 2007.

6. Steenblik R., Biofuels — at what cost? Government support for ethanol and biodiesel in selected OECD countries, Global Subsidies Initiative of the International Institute for Sustainable Development, 2007. An alternative perspective can be gained from Tyner W., Biofuels, energy security and global warming policy interactions, Purdue University, 2007.

Link posted by Kamrul Ahsan Khan | Original Source the daily star forum